It's advisable to check a quantity of choices before making a call, as this might help ensure that you are getting the finest possible deal. Some lenders may offer extra options similar to flexible reimbursement plans or tailor-made financial advice, which might further enhance the borrowing experie

Choosing the Right Provider

With the growing number of lenders providing cellular loans, deciding on the proper provider is essential. Factors to suppose about include interest rates, compensation phrases, and customer support quality. Borrowers must also Monthly Payment Loan assess the lender's popularity and browse reviews or testimonials from past prospe

Choosing the best lender entails researching various choices and considering components such as rates of interest, payment structures, and buyer evaluations. Use platforms like Bepick to check lenders and browse person experiences, which may help you make an informed decision based mostly on reliability and transpare

Additionally, these loans sometimes have lower interest rates than private loans and bank cards. This can result in appreciable savings, particularly for bigger borrowing amounts. The capability to make funds over an extended period also can Monthly Payment Loan make it simpler for debtors to manage their finances with out feeling overly burde

Each sort serves a particular function and allows users to tailor their calculations to their distinctive financial scenarios. The flexibility of these instruments makes them invaluable for making sound monetary choi

n Simplified Decision Making: With the flexibility to shortly see how varied factors affect the whole cost and monthly funds, users can make better-informed selections regarding their loans.

Budget Planning: Borrowers can estimate how a lot they will afford to borrow and plan their price range accordingly, helping to keep away from excessive debt.

Increased Financial Awareness: Understanding mortgage phrases and the way curiosity impacts total compensation fosters accountable borrowing behav

Understanding Daily Loans

Daily loans are a sort of short-term mortgage designed for individuals who require instant money to cowl sudden expenses corresponding to medical payments, automotive repairs, or other pressing monetary needs. These loans typically have a excessive interest rate but can be accessed rapidly, often requiring minimal documentation. Borrowers can apply online, making the method convenient and accessible. Understanding the basics of day by day loans is important for making an knowledgeable select

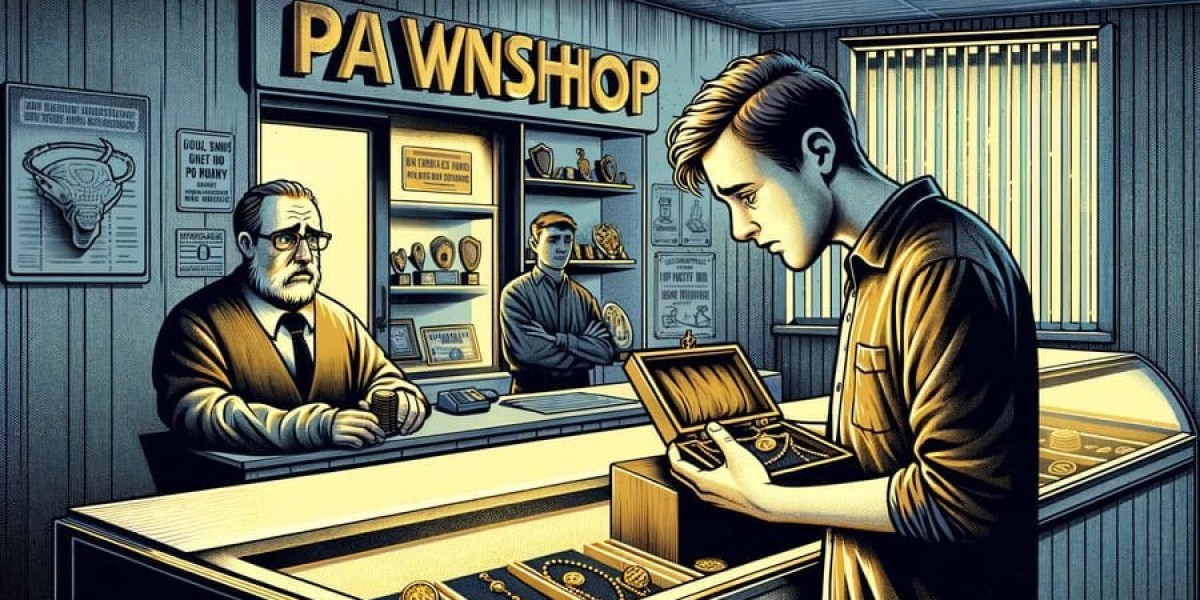

What are Pawnshop Loans?

Pawnshop loans are a type of secured mortgage where debtors provide private items as collateral in exchange for monetary help. The items can vary from jewelry and electronics to collectibles. Typically, the pawnshop will assess the value of the merchandise and offer a Real Estate Loan quantity based mostly on this analysis. The borrower then has a specified time frame, normally 30 to 90 days, to repay the loan plus curiosity, allowing them to reclaim their merchandise. If the mortgage is not repaid, the pawnshop retains ownership of the item and can sell it to recover their pri

Additionally, some lenders might require a **co-signer** or collateral to safe the loan. This can enhance the likelihood of approval and potentially decrease interest rates. It’s also important for borrowers to understand that although approval might be easier, the terms can differ broadly primarily based on the lender's assessment of thr

Furthermore, utilizing available credit can negatively influence one's credit score score, particularly if the cardholder approaches or exceeds their credit restrict. This can lead to lower credit score scores and tougher future borrowing alternati

Moreover, these calculators typically include extra features, corresponding to amortization schedules, which break down how each payment is utilized to each the principal and curiosity. This breakdown helps borrowers visualize their repayment journey, fostering a greater understanding of their monetary commitme

Applying for a Card Holder Loan can briefly have an effect on your credit score score because of the hard inquiry made through the utility process. However, responsible use of the mortgage, such as timely funds, can positively influence your credit score in the lengthy term by showing lenders you're a reliable borro

Pawnshop loans have emerged as a preferred financial answer for people in search of quick cash without the necessity for a prolonged approval course of. These loans permit people to leverage personal belongings as collateral, offering instant funds while maintaining the items safe in the course of the loan period. In this text, we discover the intricacies of pawnshop loans, their advantages, components to assume about when using them, and the way platforms like 베픽 supply useful insights for potential borrow

Unlike different loan types, unemployed loans could not require proof of income or a lengthy credit historical past, making them accessible for lots of. However, it’s important for potential debtors to thoroughly understand the phrases, interest rates, and repayment circumstances related to these loans. Each lender will have various requirements, which can significantly have an effect on the general price of borrowing and the financial burden on the person once they're employed once m

akilahbuzzard

47 Blog posts